When you come to this page, we are sure that you are looking for information about what services Fidelity offer. If you really want to get that information, we suggest you to read this entire article.

What services does Fidelity offer?

Fidelity provides the financial planning and advice investors need, including:

-

- Retirement planning

- Wealth management

- Trading & Brokerage services

- College savings and more

Their straightforward pricing will deliver value with no account fees, no minimums to open a retail brokerage account, commission-free trades and more.

Retirement Planning

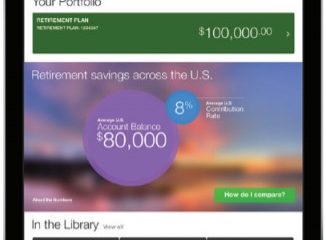

Keep in mind that planning for retirement is an ongoing journey. Owning a flexible plan for retirement is going to help prepare you to reach your main goals, whether you are saving or already retired. Let us see how small changes could increase your outlook. To get started on retirement plan, simply you are able to click at the blue Get Started button. After that, you are going to be asked to login to your account. If you are a new user of Fidelity, then you need to register now.

By the way, where are you in your retirement journey?

-

- I am saving for retirement

It will not too early or too late for you to start saving. Fidelity will help you make a plan based on how far away you are from retirement.

-

- I am retired or nearing retirement

The team of Fidelity is going to check how much you will need, how much you have already saved, and they are going to help you making an income plan for cash flow.

Wealth Management

You are able to work with a dedicated advisor who will help you build a flexible plan which is designed to adapt to your changing needs and assist grow and protect your wealth over time. It will start with a conversation. Let us find an advisor!

-

- A dedicated Fidelity advisor

Your advisor is going to help you define your goals, understand your options, and proactively work with you to develop and implement a clear plan.

-

- Comprehensive planning

Fidelity will assist you building a plan about your financial designed to grow your wealth, assist you pursue many goals, and also take care of people who matter most to you.

-

- Personalized investment management

Your advisor will help you select an investment strategy based on your preferences and feelings about risk, which Fidelity’s investment team will proactively monitor so that it will continue to meet your changing needs.

Trading & Brokerage services

This is a smarter trading technology, plus $0 commission trades, means that smarter trading decisions. It is Decision Tech. You are able to open a brokerage account easily.

Whether you trade a lot or a little, Fidelity will help you get ahead.

-

- Commission-free trades

$01 for online United States stock, ETF, and option trades. Customers of Fidelity will get margin rates as low as 4.00%.2

-

- Fractional share trading

Stocks by the SliceSM creates dollar-based investing easier. Customers of Fidelity will be able to have a slice of your favourite companies and ETFs.

-

- Decision-making technology

Customers of Fidelity will get smarter trading technology and dedicated support to help inform your trading decisions.

Choice and transparency:

-

- Broad option of investments

Access a range of investments, including stocks, ETFs, options, mutual funds, CDs, IPOs, and precious metals.

-

- Industry-leading execution quality

As one of commitments of Fidelity to execution quality, the customers saved over 1.6 billion dollars through price improved trades in the year of 2020.

Trading insights for today’s markets

To assist you be more effective with your research and analysis using Fidelity’s trading platform and tools, the team of Fidelity offer a breadth of educational resources.

-

- Webinars

You are able to get an edge with market insights and topics. From strategies to technical analysis, via live and on-demand webinars.

-

- Coaching sessions

You are able to join their Trading Strategy Desk® coaches to assist build your knowledge on technical analysis, options, Active Trader Pro, and more.

-

- Podcasts

You will be able to learn about today’s most essential economic topics, and how they affect the everyday investor. In the Money: You are able to get insights, commentary, and ideas to assist you trade smarter.

-

- Active investor insights

You are able to get actionable, up to date investing ideas with technical analysis and strategies to assist you with today’s investing.

529 College Savings Plan

529 College Savings plans are flexible, tax-advantaged accounts designed for education savings. Funds are able to be used for qualified education expenses for schools nationwide.

By the way, who can open a 529 plan account? United States residents, all income levels. For your information, there are no income restrictions on 529 plan account. To open the account, you have to be a United States resident, age 18 or over, with a United States mailing and legal address, and also a Social Security number or Tax ID.

Why invest in a Fidelity 529 College Savings plan?

Here are some reasons why you should invest in a 529 College Savings plan with Fidelity.

-

- Tax advantages

While your money is in your account, there are no taxes will be due on investment earnings. When you take out money for qualified education expenses, withdrawals are federal income tax-free.

-

- Flexible use of funds

You are able to use money in your 529 College Savings plan for many college expenses at accredited schools nationwide.

-

- Lots of investments choices

Select either an age-based strategy or a custom strategy.

-

- Straightforward pricing

There is no annual account fees or minimums when you open a 529 College Savings plan account.

We get information that some states offer good tax treatment to their residents if they invest in their state’s 529 plan. The beneficiary’s home state 529 plan is going to offer additional state tax advantages or other state benefits such as the scholarship funds, financial aid, and protection from the creditors. If Fidelity does not manage a plan for your state, probably you want to consider the UNIQUE College Investing Plan.

AUTHOR BIO

On my daily job, I am a software engineer, programmer & computer technician. My passion is assembling PC hardware, studying Operating System and all things related to computers technology. I also love to make short films for YouTube as a producer. More at about me…