You come to this page to find out how to log into your Fidelity NetBenefits account, don’t you? You may already know in order to get access to Fidelity NetBenefits, you need to login with your Fidelity account first. Unfortunately, you have not yet learned how to do it, as you’re a newcomer to Fidelity.

Don’t worry! This post will give you a guide to log into Fidelity NetBenefits. However, Fidelity definitely answers your need for your financial plans for the future and any investment services which allows you to get a better future when you retire from your current job. Let’s see our guide below!

Logging Into Fidelity NetBenefits, Here’s the Guide!

In order to get access to Fidelity NetBenefits, you should login first with your account. To login into Fidelity, follow some steps below!

-

- First, go to the official Fidelity site here.

- After you are at the page, you must login with your Fidelity account by entering your username and password.

- Then, click on the Login button.

How if you have not yet a Fidelity account? What you should here if you do not have a Fidelity account yet is to create it before, by following some steps below!

-

- Click on the link to access Fidelity as we’ve mentioned above.

- At the login page, you have to scroll down until you find the register option.

- To create your account, you need to click on the ‘Register as a new user’ button. Fortunately, creating your Fidelity account may not take a long time.

Congratulations! You already have a Fidelity account and start to explore the Fidelity services.

How to Change Your Fidelity Investment Option?

When you decide to pick out one of the investment services offered by Fidelity, you may still be confused, as your future is still a mystery. On your way to saving retirement savings, you may want to change your current investment option to another. don’t worry! Fidelity will answer your needs.

At the homepage of Fidelity, you will find the ‘Quick Links’ section. This section provides a bunch of easy and fast navigation to what section you want to go. One of them is to give your way to change investments option by accessing the ‘Change Investments’ section

Aside from changing your investment option, you can also change your future contributions to the Savings Plan or also move assets from one investment choice to another.

Follow some steps to change your investment options below!

Investment Election section

-

- To change how your contributions for future plans will be invested, you need to click on the ‘Investment Elections’ section.

- Here, you need to select the ‘Source’ either rollover contributions or automatic payroll deductions

- Then, you should type the percentage that you want to invest for each option.

- Last, click on the Update and Continue button.

Exchange section

If you want to move your current balance from one single investment choice to another, you need to click the ‘Exchanges’ section.

-

- What you should do here is to select the investment option to exchange from.

- Then, you need to type the amount you want to exchange.

- Last, select an investment option to exchange to.

Rebalance section

You can take advantage of ‘Rebalance’ section if you want to move your current balance between multiple investment options at one time

-

- If you want to move your current balance, you need to sign up for email alerts through ‘Rebalance Notification’.

- Aside from that, you should also have your account automatically reset to your desired allocation on a regular basis, through ‘Automatic Rebalance’.

Well, those are multiple ways that you can perform to change your current investment option to another. Make sure to choose the best one which fits your future plans.

Important Navigation Guides

This post will also show you the navigation which will ease you to get help and take some action within. When you access Fidelity, you surely will be taken to the Homepage. Here, you will be able to view your BP pension and savings benefits.

Some navigations that you will find at Fidelity homepage include:

-

-

Important message

-

This navigation allows you to receive important information that you should act on.

-

-

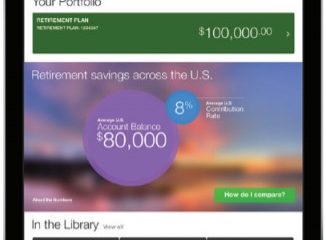

Your Portfolio

-

Through portofolio, you will find a total balance for all your workplace and Fidelity accounts. It also provides retirement income based on a variety of savings rates.

-

-

Link to Income Simulator

-

This navigation allows you to view the potential effects of saving more or changing your investments.

-

-

Account Balance Tiles and Access

-

Through this navigation, you’re able to view your balances and also get access to your savings account and BP pension. If applicable, you can also see your personal accounts and stock plan.

-

-

Quick Links

-

This Quick Links is such an important navigation at Fidelity homepage where it will direct you into balance and transactional screens for each selected plan.

-

-

Make the most of your benefits

-

This section allows you to view resources related to your BP pension and savings plans. Aside from that, you will also find the essential educational information, financial news and more.

About Fidelity NetBenefits

Fidelity was named as one of the largest financial planning companies in the world which is also known as a privately owned investment management company. This company was established in 1946 and based in Boston, Massachusetts.

Fidelity comes to answer your need to plan and save your pension money. They definitely organize your pension savings correctly. With the help of Fidelity, you can really contribute your retirement savings correctly. However, the retirement plan offered by Fidelity gives you ease of saving that you will allocate for your old age.

In fact, it’s not easy to save and allocate your salary for your retirement savings. Well, with Fidelity, your plan for pension savings will be managed well. However, they can help you stay on the right track so that your goal of saving for retirement is faster.

So, from now on, make sure to take consideration to make contributions for your pension savings with Fidelity. Aside from Fidelity, there are also other services offered including wealth management, fund distribution and investment advice, life insurance, and securities execution and clearance.

AUTHOR BIO

On my daily job, I am a software engineer, programmer & computer technician. My passion is assembling PC hardware, studying Operating System and all things related to computers technology. I also love to make short films for YouTube as a producer. More at about me…

Leave a Reply